Wind/Solar/Batteries & the Public Utility Racket

More Utility Investment = More Revenue = Unnecessary Medical Procedures

In the American psyche, perhaps there is no better example of a public utility than the transcontinental railroad. Brigham Young was the first fully-paid shareholder of the Union Pacific Railroad for good reasons. He saw the power of steam-driven iron wheels. Ogden City, Utah soon became the Union Pacific / Southern Pacific demarcation point and the place where many of my ancestors first set foot in Utah from England and Denmark. Union Station is also the spot where Winchester’s Thomas Bennett landed in 1883 to hunt down my third great-uncle, John Moses Browning so he could buy Browning’s 1879 patent. The $20,000 cash payment made JMB one of the richest men in Utah. But that’s a different story altogether.

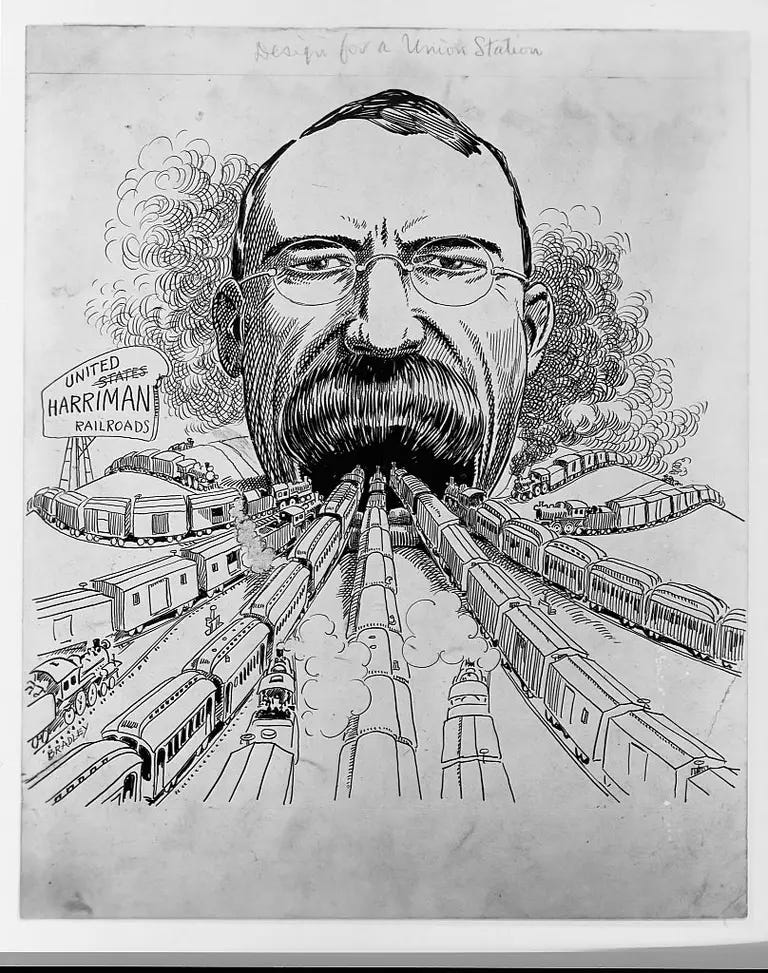

As extraordinary as was the accomplishment, the legal and economic conundrum it created was just as enormous. Prior to 1887, railroads were unregulated, private businesses. But they were monopolies. They set their own rates, excluded competition, and discriminated in the prices they would charged to passengers and shippers. Smaller market participants were especially disadvantaged. They didn’t call it the Wild West for nothing. Then again, had it not been for a March 1, 1901 check in the amount of $798,546.85 from the estate of E.H. Harriman, Utah’s magnificent State Capitol building would have been significantly more modest.

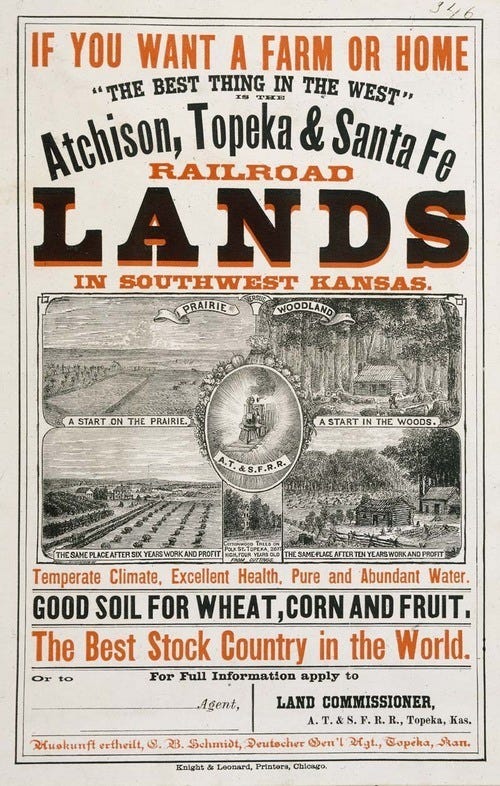

But railroads were different than other businesses. Their monopolies came about because of enormous public subsidies. In the 1862–66 period alone, railroads gobbled up more than 100 million acres of public land. Altogether, the roads received about 183 million acres of land.

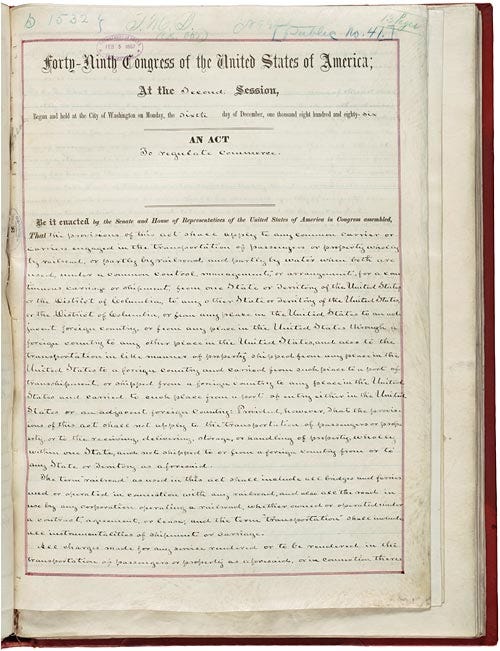

Congress' solution was the Interstate Commerce Act of 1877, which created the Interstate Commerce Commission (ICC). For the first time, private businesses were regulated by the federal government.

Among other things, the ICC set rates the railroads could charge for services based on non-discriminatory, published tariffs. Importantly, the rates were to be based on the railroad’s actual "cost of service," with allowance for reasonable profit for equity (stock) owners. Thus, the US created an entirely new kind of business, the privately-owned, regulated public utility. And it’s a totally different kind of business altogether.

In a normal business, equity is entitled to share all the profit of a business because equity is the most at risk. If a business becomes insolvent, the creditors get paid first and equity is wiped out. Risk=Reward. But the utility business involves a monopoly. And monopolies don’t have competition. The risk of bankruptcy is very low. In addition to profit sharing, equity owners are entitled to control business management and, maybe most important, enjoy all the benefits of natural appreciation of the business’ assets.

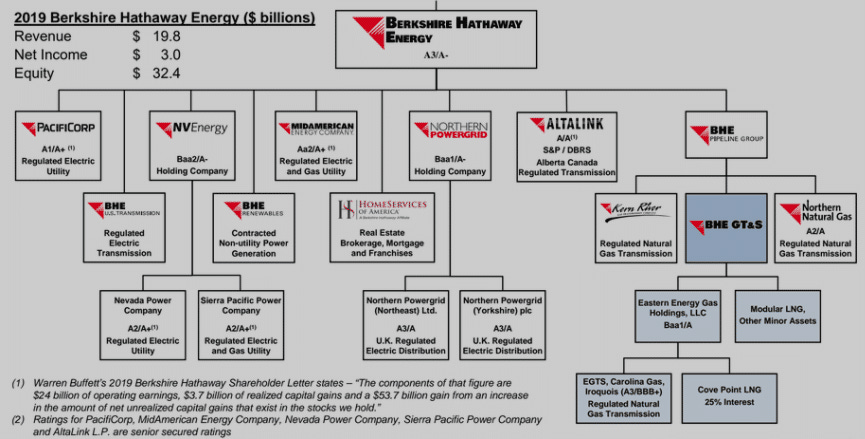

This may look like a boring chart. But it’s not. Regulated utilities are special businesses - and that’s why Warren Buffett can’t own enough of them. The bottom part of the slide bears repeating:

Far from being at risk, utility investment is a cash-printing safe haven, with all the advantages of owning a monopoly. Utility owners are incentivized to invest as much equity as possible. And they do that by building new infrastructure inside the rate base. Utilities crave infrastructure.

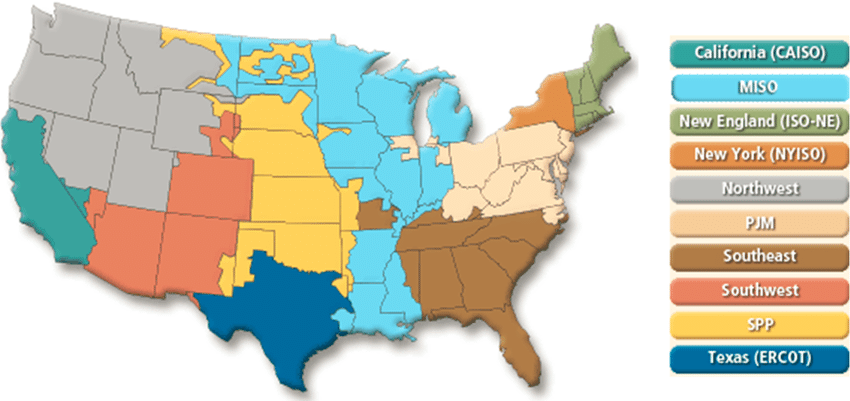

With the advent of coal gasification (generating methane from coal), electrification, and telephone communications, and so forth, the same public utility legal model as was adopted in the railroads was also adopted. Intra-state utilities were to be regulated by state Public Service Commissions (PSC); interstate utilities were to be regulated by federal agencies (today, primarily FERC and the STB).

Today, we have the federal government heaping on the subsidies and public utilities screaming to gobble up all that infrastructure into the rate base. Who pays the rate base? Hint: Not the project developer. Not the utility. So who protects the lowly ratepayers? Well, that varies depending on the regulating authority. Usually the state PSC or FERC.

Problem with wind/solar/batteries is that they basically have federal and state cram-down status to mute ratepayer opposition. But not always. When looking at any project, keep the rate base in mind and figure out who is watching the chickens.

So, the utility racket is trying to get as much self-built infrastructure as possible past the regulator and into the rate base. New utility infrastructure is usually financed 50% equity and 50% debt. So, for every $100 million project PacifiCorp gets to hang on the PSC, Warren Buffett get to sell $50 million in new, high-value utility stock. It’s like printing money.

Modern policy support for wind/solar/batteries is a Utility Gold Rush because the regulators are basically kicked out of the room. They can’t say no. On top of that, as over-investment in wind/solar/batteries make the electric grid more unreliable, politicians require more investment to fix the grid. Build Baby Build!

Now, under the Inflation Reduction [Production] Act, NEW TRANSMISSION to support wind/solar/batteries is like a railroad. Buckle up. Ain't nothin' gonna stop it. The train has left the station. And utilities are cashing in. Transmission: The New Utility Gold Rush

Put on a hospital gown because we're going under the scalpel. Here's the new and totally unnecessary interstate transmission system that's going to cost ratepayers a bundle, for no good reason. Source: S&P Commodity Insights

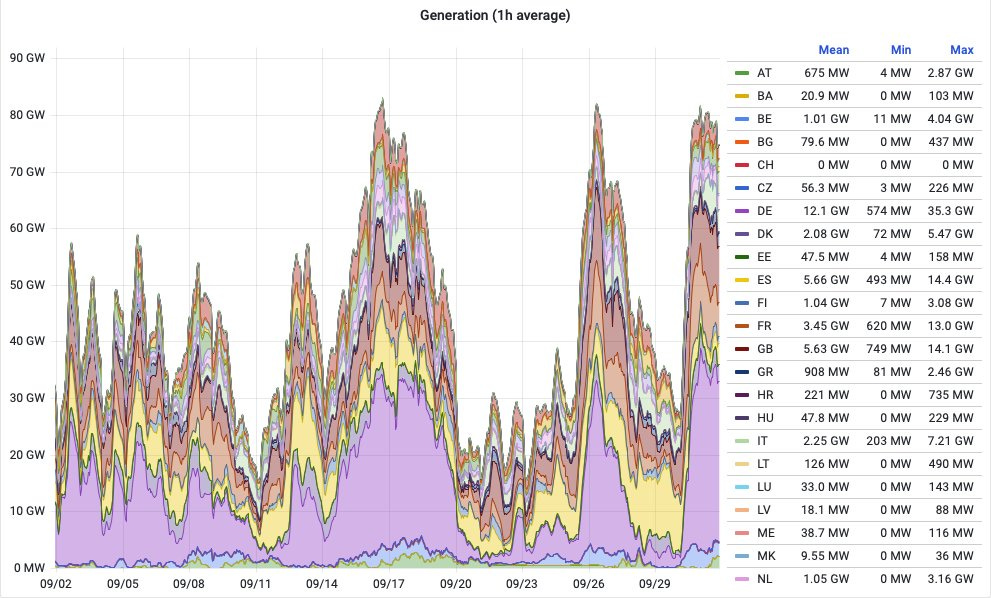

And the new power we’ll be paying to transmit part of the time in the unnecessary transmission lines is as worthless as a Patent Medicine formulated by Rube Goldberg himself. Open wide! Source: @MartianManiac1

NOW consider what France accomplished in 10 years. No unnecessary transmission. No wind. No solar. No batteries. No cobalt. No lithium. No silicon carbide. No child labor in Africa. Shocking I know but truth is that wind/solar/batteries is a Rube Goldberg farcical solution to a very simple thermal energy need civilization requires.

Compared to that Rube Goldberg unnecessary medical procedure, society would be orders of magnitude better served by deploying Enrico Fermi's humble invention, which is as fateful for humanity as when humans first discovered the secrets of fire.

They want an unstable grid! That just means more stuff! Emergency!

This is a terrific article. It's why my colleague Mitch and I always model the utility profits in our research. https://www.americanexperiment.org/reports/the-high-cost-of-100-percent-carbon-free-electricity-by-2040