In my recent thread about the realities of chaos in the natural gas supply chain, Jesse, a practicing industrial process engineer, pointed out:

To appreciate this observation requires at least some energy project finance background. Most people don’t appreciate how hard it is to finance infrastructure. You need a defined income start date, a good idea what the revenue stream will be, and some assurance that things will stay that way during the finance period—say, 20 years. Boom-Bust is the worst. Today’s price might be sky high but trying to convince a lender requires a wee bit more.

Jesse’s flollow-up comment bears repeating:

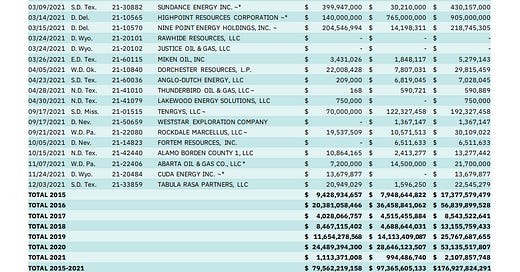

Lenders and stock buyers hate chaos. Chaos means unpredictability. And that means risk. Even in high-price years, insolvencies happen. Haynes Boone has been tracking US E&P bankruptcies since 2015.

Cumulative total, nearly $177 billion in secured and unsecured liabilities rinsed through the credit system. In the USA, bankruptcy [nearly] always wipes out equity—zero. The secured creditors get their assets back. The unsecured creditors become the new shareholders (Chapter 11) but usually get nearly 0 in a liquidation.

Look How Much Gas We Are Saving!

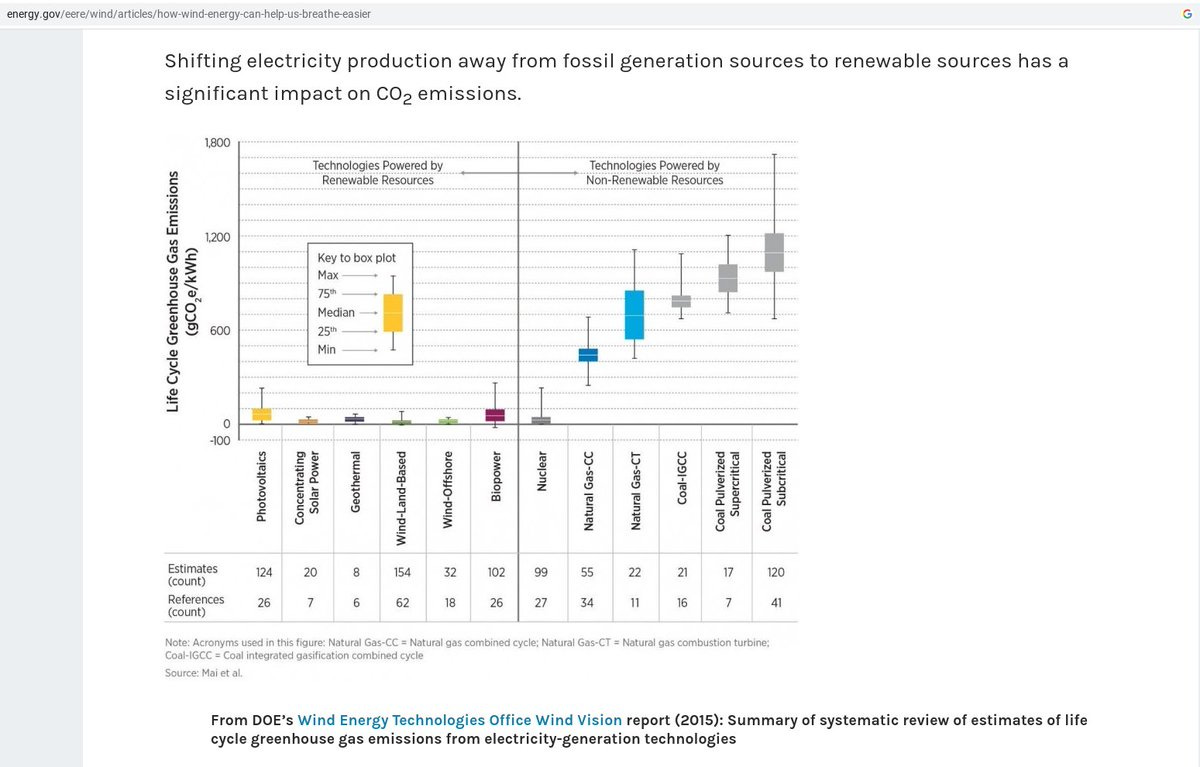

The premise of Rube Goldberg Wind & Solar machines is that they “save” so much natural gas that they will change the Climate. But like the climate, energy systems are enormous, complex beasts that defy shallow assumptions. Like all the assumptions embodied in this slick, Theranos-worthy graph:

All the modeling in blithely assumes a Natural Gas Powerplant vs. a wind farm connected to the grid, in perfect, harmonious balance. For every electron of electric generation made by Clean Energy, humanity “saves” an equalent volume of natural gas—because that should be obvious to anybody who has a brain and lives on planet earth, so much so that few question absurd oversimplifications like this:

But if you go all the way back up to the top of the NG supply chain, you find this option: Flaring.

Without wading too deep into the government's attempt to greenwash flaring, the fundamental problems are economic. Temporary gas collection and processing infrasctructure connected to an interstate pipeline is expensive!

Methane flaring wastes millions of dollars on Utah’s public lands, but are federal limits a good solution or an undue burden?The Interior Department is poised to dramatically roll back new methane-waste prevention rules for oil and gas operations on public and tribal lands.https://www.sltrib.com/news/2018/04/14/methane-flaring-wastes-millions-of-dollars-on-utahs-public-lands-but-are-federal-limits-a-good-solution-or-an-undue-burden/

Low gas prices caused by a chaotic market—because wind and solar are "saving" so much gas for us (which we have to pay for whether we use it or not), resut in—guess what? More flaring at the wellhead. Economics 101. “Saving” natural gas in a chaotic, unpredictable manner does not save much natural gas at all. It just gets wasted at the wellhead. And exactly 0 magic Lifecycle Assessments or ESG Stock Reports take any account of it. “If you can't see it, it doesn’t exist.”

All by design so they can socialize the system. Government money will control production thru corporations