LCOE = no shipping. Imagine a factory that produces low-cost widgets intermittently. One hour maybe thousands. The next hour zero.

Widgets have ZERO value unless loaded IMMEDIATELY onto waiting trucks. If you miss the loading window, widgets are worth Zero. That’s curtailment.

But delivery trucks are by no means free. Depending on how many you want to pay for, they can cost more than the widget factory itself. If you don’t have enough, widgets are worthless. Too many and your widgets cost a lot to make.

While delivery trucks are waiting 24/7 to pick up widgets, they can’t haul anything else.

As a widget factory owner, I don’t want to pay for trucks. So naturally I lobby politicians to make widget consumers buy my widgets, priced FOB at my factory. That’s LCOE in a nutshell. Pretend trucks don’t exist.

Now imagine a different kind of widget factory where I can control widget production at a set rate. 2MM widgets a day, 24/7. Plan it all out in advance.

Instead of trucks, I plan to deliver widgets to market via rail at scale, planned out, economies of scale, full utilization of the transportation infrastructure.

Factory #2 requires more capital but the reliable, delivered cost will be much lower. So #2 can enter firm contracts while #1 cannot.

Now imagine yourself a widget buyer (eg grid operator). You need widget supply at all times 24/7 or your business dies. But your widget consumption also varies minute but minute, hour by hour, day by day. You need instantaneously-delivered widgets, 24/7.

For the widget buyer, FOB pricing at Factory #1 is totally irrelevant. What is my delivered cost and schedule when the factory can deliver widgets? What if I need more widgets in an hour? Or right now?

Factory #2 may have higher LCOE but it can be turned up and down with immediate, low-cost delivery. The two factories are not comparable.

The real LCOE game is an Enron-style accounting trick for wind/solar. ASSUME that widgets don't have to be delivered. Assume that widgets at the point of generation are 100% delivered on time and fully utilized. Assume an average production rate over a full year.

So with all the Enron accounting ASSUMPTIONS above, compare Factory #1 and Factory #2. Obviously, Factory #1 makes widgets way more inexpensively than Factory #2. GAME OVER. SCALE UP. FEED ME SUBSIDIES till the end of time!

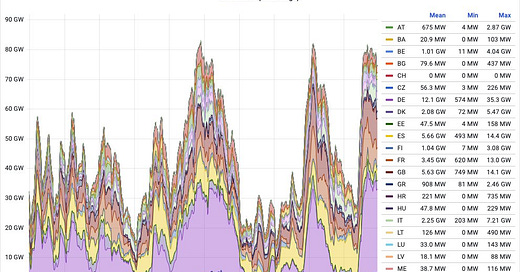

Behold, Widget Factory #1 - for which Germany literally threw out 17 paid off #2 factories. BUT LCOE! Source: @MartianManiac1

Utility Industry Secret: Chaos pays in the utility racket. They need even MORE INFRASTRUCTURE for “reliability.” They're playing their own game: Hang as much infrastructure AS POSSIBLE inside the rate base. Guaranteed rate of return + appreciation (equity) potential. Warren Buffett can't ever get enough.

Factory #2 (nuclear power) is at the bottom! See the difference? If you're the grid operator, which widgets are worth most? Source: @MartianManiac1

Misapplication of LCOE metric leads to gross false equivalence errors. Among other errors, FOB pricing - shipping not included. There’s a huge cram-down of wind/solar into our grids. I highly recommend this book for more details. @MeredithAngwin

Here is the LCOE game presented in another graphic. Imagine having to pay all the Shipping Costs for the Red “energy.” Who has to pay for the standby trucks while red is not working?

I’ve posted multiple Twitter threads I’m converting over to substack. This is a much better platform. I’ve got a lot to say. I’m thinking about recording some podcasts.

It's gonna take days to digest the first one - slow down or you'll lose people and the comment threads will be less interesting... I need to get my copy of Shorting... back from the newspaper reporter I gave it to...