Chaos Theory (the “butterfly effect”) owes its very existence to Edward Lorenz’s compter-aided study of the weather. There is hardly a more chaotic system than the weather.

Energy Project Finance: It might sound complicated but it's not much different than any other asset-based loan. Energy projects are financed on a stand-alone basis, meaning that the project must be self-sustaining.

In this diagram, the "Little Energy Co" is the stand-alone business entity that owns and operates the energy project (OpCo). The OpCo owns the assets; has all the energy sales contracts; has all the liability; services the debt; and pays net profits to the equity owners.

Traditionally, equity investors need to put in about 50% of the project costs in order to entice lenders to put up the other 50%. Equity gets all the profits and lenders only get interest, so lenders are more at risk (they have less upside and only defined income).

Energy projects present enormous insolvency risks because they are almost always no-recourse deals. Lenders’ only security is the project itself. If the project goes belly up, the lenders often inherit worthless assets. Offering lenders security interests in energy projects is not necessarily all that compelling. If the project goes belly-up, then the leftover physical assets probably aren’t worth all that much (or the project would still be solvent).

Even more important, the project finance period is usually the entire operational life of the assets—usually in the 20 to 30 year range. Project proponents have a heavy burden to get loans. They have to prove project solvency and profitabiltiy for the entire finance period.

In the 1970s, the Los Angeles Department of Water & Power (DWP), the largest public power entity in the USA, decided to build an enormous coal power project in Utah and connect it to California via a massive, direct current transmission system. Both the plant and the transmission needed to be financed simultaneously; they were a matched set.

Nobody deserves more credit for pulling off this project—the largest public power project in U.S. history at the time—than attorney Ronald L. Rencher. In the 1970s, Ron had served as the Speaker of the Utah House of Representatives. Putting this project together (a new plant; long-term coal supply and transportation; a new transmission line from Utah to California) was almost nearly impossible and required millions aind millions in high-risk investment.

I had a conversation with Ron a few months ago. We practiced law together for quite some time and I wanted to tell him that he is on my short list of favorite people I've ever known in my life. When I was working with Ron, his energy practice was nationwide. It was one of the best professional experiences I have had in my decades practicing law.

Attorney James C. Burr has an impressive, nationwide energy project finance practice, and for good reason. Jim is among the most effective attorneys I've ever known. He could be practicing anywhere--very few of his deals are in Utah. I did not work with Jim as long as I did with Ron, but I also count the time as being professionally and personally rewarding.

I could talk about energy project finance for hours, but here is the short version: To say that energy project finance deals are complex would be a grossly oversimplified understatement. And this naturally leads me to this book by @MeredithAngwin. She demonstrates just how fragile the grid is, that the energy system is chock full of perverse incentives and absurdities (such as allowing Wind and Solar to bid their future “capacity” into capacity markets). There are no solutions in sight.

To me the reasons for this are self-evident and obvious. What is really going on here is a massive economic fight between two mutually-exclusive groups of energy project developers & investors competing for new projects: (a) Firm Power and (b) Weather Power. A grid without Chaos is supported by projects that are financeable. A grid with Chaos is not easily financable:

I say mutually exclusive for good reason. The ultimate fight is which group of investors (and their lenders) is going to be required to eat $0.00 Revenue (aka curtailment). The Firm Power group also faces the extraordinary costs of cycling their plants. Whenever a project has to eat $0.00 revenue at unpredictable times in the future over 20 to 30 years, the financial viability of that project becomes 0.0000000. The same chaos that drives the weather is now making our grid fragile both operationally and economically. All this for no good reason.

There are neat and tidy words to describe this fight. CAISO, the California grid authority, for example, uses “oversupply mitigation” and such terms to describe what I would describe more clearly as Mutual Exclusivity. One group of investors and lenders needs to eat the risk of $0.00 revenue on a chaotic schedule. The winner will build more projects; the loser will build no new projects.

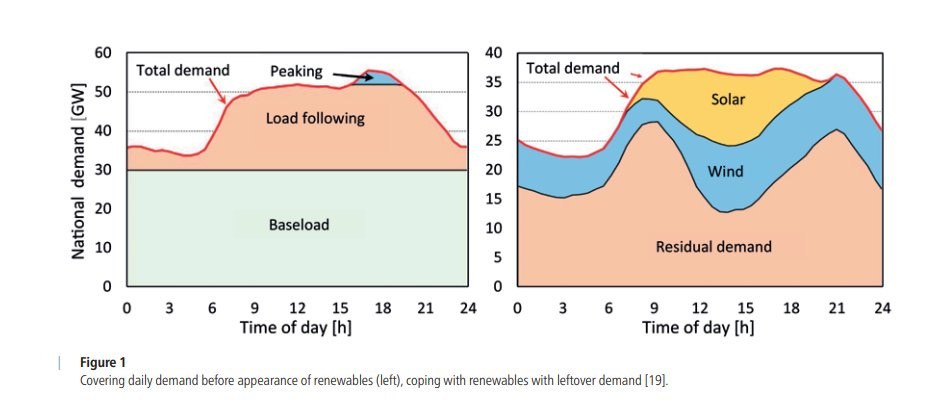

In addition to reserve power, variability in generation resources is placing extreme stress and premature wear & tear on Firm Power resources. This is because the Firm Power resources are required to turn off and on very quickly. This chart is known as the Duck Curve but I see it as the Weather Pit. CAISO correctly states that the Duck Curve is not sustainable. Who knew? But it keeps getting deeper every year. We are digging a Weather Pit and it's going to cost a lot to get out of it someday. But first we need to stop digging. Good luck.

The more Weather Power, the more ramping. The need for horsepower-based ramping keeps going up because the grid is increasingly exposed to the weather. Ramping and cycling literally wrecks Firm Power resources faster than their design life, and requires the addition of even more Firm Power resources over time. Yet politicians have so over-subsidized Weather Power, mandating that Firm Power eat curtailment along the way, that few new Firm Power projects can be financed. Hence, the fragility of the grid.

The Weather Pit is so deep that Firm Power producers are going bankrupt. So what’s the government’s solution? More direct subsidies!

And guess who pays all the bills? The same people who get stuck with the fragile, absurdly inefficient and overbuilt grid. We pay all the bills.

Weather Power introduces Chaos into every part of the electric energy supply chain: Sales; Supply; Revenue; Operation & Maintenance. Chaos increases risk. Risk means: No loans; higher interest; higher borrowing costs; higher equity costs. No new projects. We occupy the Age of Energy Absurdities.

Ramping and destroying Firm Power plants long before their design life both have direct Carbon Costs that could be calculated. How many Lifecycle Assessments for Wind & Solar include these embedded carbon costs? I'd bet a steak dinner it's 0.00%.

LCOE! Wind & Sun are Free.

For further reading along these lines, consider:

Grid operational Chaos:

Grid Operational Chaos Redux:

Grid Economic Chaos:

Natural Gas Supply Chain Chaos:

Guess what? If we can’t finance natural gas infrastructure because of Chaos, natural gas just gets flared at the wellhead:

Solar and wind are fine examples of the ByProduct Theory of commodity projects. In my years in refining, we continually saw proposals to use the "free" petroleum coke that was produced as part of a process to make more gasoline out of the heaviest parts of a barrel of crude. Basically the impurities in the rest of the barrel tended to land here in a big solid coal-like chunk that was then broken up, hauled off and usually burned in cement kilns and such. A continual parade of developers offered to 'take' this stuff off our hands for use in all kinds of schemes. The response was usually, "great, you can pick it up underneath those big cylinders in the middle of the plant - no charge". After adding up the cost for trucks to move the stuff to a port and machines to keep it piled up until the ship came in plus conveyors to load it, or the railcars to keep it moving out and off to the location where it would be used, the thrill disappeared and so did the project. Solar and wind are similar - the sun's rays and wind are "free", but capturing them, converting them into usable energy and transporting it to a customer are not. A lot of the money made in the energy business is simply logistics and "swing management" - serving as the part of the supply chain that sits between a facility that needs to operate at a constant rate to be efficient and a market that consumes at a variable rate. The value of the commodity includes the value of "basis" - time and place in addition to physical properties that make the commodity suitable for the use it's being bought for.

Intermittent power is to the grid as afib is to the heart. It is an easy problem to fix. King Poo-bah commands gravity, the tides, and chaos itself ... Short of that, can you buy paddles for grid afib from Amazon? Perhaps all intermittent sources can run into a magic battery then sell power in blocks becoming dispatchable and predictable. Predictable for sure: pay me 10x, wait, 30x, and I will make all intermittent sources non-intermittent. Or fission. Sooner or later the waste bogeyman will be exposed as a hollow argument, and we can really begin to provide for humanity.