Twitter is chock full of absurd energy nonsense, like this one:

Meredith Angwin’s reply prompted me to realize that most people probably do not understand some basic principles regarding methane. I could not resist the impulse to tweetstorm a bit.

As a fuel, methane is abundant, clean, and versatile. On the bad side, it is costly to store and deliver where and when it's needed. In my private law practice, I supported several utilities—regulated and unregulated—in their fuel supply arrangements. I also had occasion to do legal support work on tens of thousands of miles of interstate pipelines, storage, and distribution systems.

People are grossly oversimplifying these systems because they don't understand them. The over-reliance on chaotic generation (wind and solar) is also wreaking havoc on the reliability of the world's natural gas supply chain.

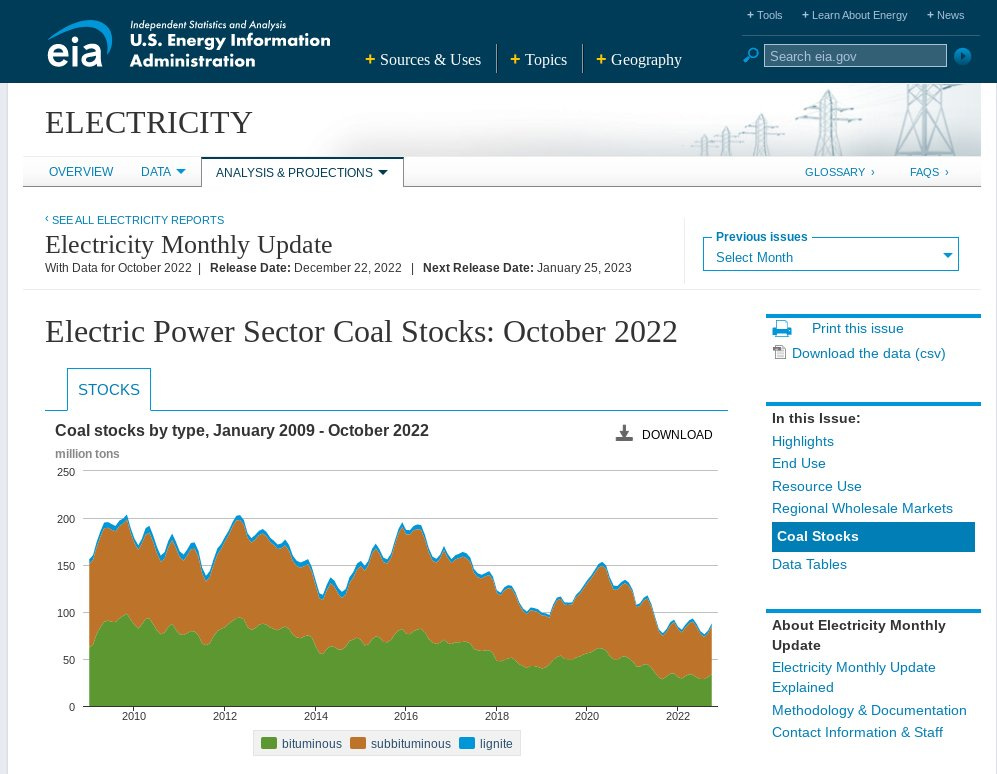

A primary difference between coal and methane is that coal is easily stored. Generators burning coal have greater flexibility than those burning gas. Utility coal stockpiles are regularly monitored.

With coal, "mine-mouth" power stations are fairly common. It's easier to ship power than coal. In Colstrip, Montana, for example, coal is delivered to the power station via conveyor belts that just keep getting longer.

“It’s a Gas.” Tom Hess

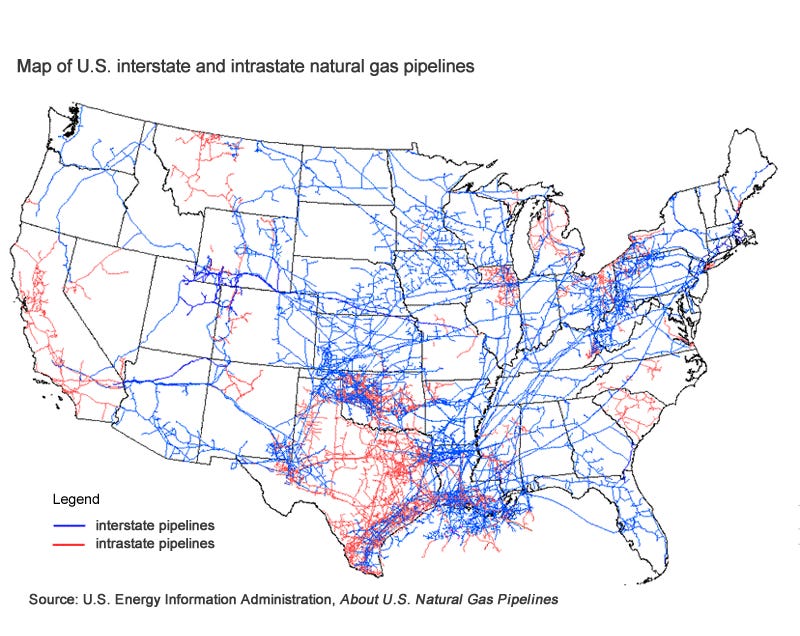

Natural gas power plants are fundamentally different. Where do they get their fuel supply? Unless the plant is physically located next to convenient underground storage caverns (which are rare in geographic terms), the plant has to get its gas from a pipeline.

This is where things get tricky. Pipelines move gas; they do not store gas. Pipelines are highly constrained by their design throughput; they need to run 24/7/365. There's no stopping it. Think of it like this:

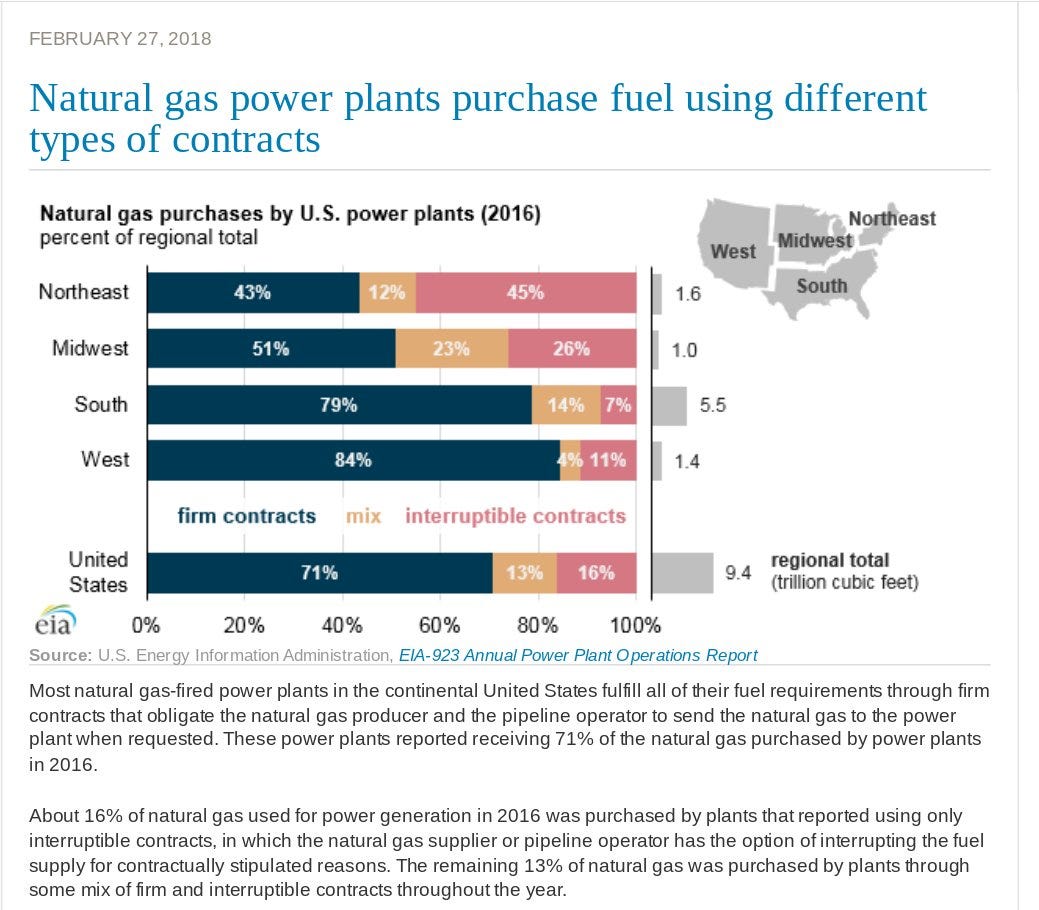

You might be able to buy gas fairly inexpensively, but you've also got to take physical delivery or, more correctly, pay a lot extra for firm delivery. Extreme variability wreaks havoc on gas supply. And that's because of firm vs interruptable gas supply contracts.

Firm contracts mean that the supplier is obligated to provide the gas supply; interruptable contracts are the back-fill. The actual throughput of the pipeline is unchanged. Firm contracts cost a lot more because you're paying to be first in line.

Gas power plants in the northeast likely don't have the ability to buy more firm gas contracts or they would. Pipeline capacity up there is extremely constrained. That is not likely to change any time soon because New Englanders hate natural gas pipelines.

Except for @MeredithAngwin and many others who understand the objective realities of tradeoffs. But maybe it's not about mistaken beliefs after all. Some special few are making bank importing LNG into New England.

Why Is New England Paying The Equivalent Of $180 Oil For Natural Gas?Today New Englanders have reason to feel a little more … European than usual.https://www.forbes.com/sites/christopherhelman/2022/02/01/why-is-new-england-paying-the-equivalent-of-180-oil-for-natural-gas/?sh=3a77435d30a7

The gas supply system in the US is comprised of large, interstate pipelines regulated by FERC. As with RTOs on the electric side, these pipelines are common carriers, with approved rates based on tariffs approved by FERC. 3 million miles.

Layered Contracts - High Overhead

Think of the natural gas supply chain like a coal mine (production well) and railroad (interstate transmission), except that the overhead for the natural gas system is orders of magnitude more expensive. Because methane is a Gas. And gasses don’t like to be contained.

Imagine yourself a gas buyer for a power plant in a market that has high “penetration” of cancerous tumors I like to refer to as Rube Goldberg Wind and Solar. Your state mandates that when the wind blows and sun shines, you’ve got to close down your plant and you can’t burn natural gas from the pipeline connected to your plant. Because the wind is blowing.

At the same time, your natural gas plant is required to stay online with 100% availability in case the wind stops blowing or a blizzard ices up the windmills and covers the solar panels. Or the sun goes down. Then it’s game-on, 100% power or people will die. But in the winter, those same people also will be burning lots more natural gas than at any other time.

Well, you need to set up at least two sets of contracts:

Supply (the gas producer-owner)

Delivery (from the gas processing facility to your plant)

Gas supply and delivery are totally different things. The delivery systems are common carriers, not much different than railroads or trucking companies. Except they ship gas. The delivery leg will almost certainly include some storage services, but there are fallacies about storage. The input/output of storage facilities is constrained. And the output side of a gas storage facility is yet another pipeline.

Both the production and delivery systems have maximum throughput over time, especially because gas is hard to store. As you may imagine, all of these agreements need to be set up well in advance and need to correlate to the amount of gas you project to be needing in the distant future.

Take or Pay

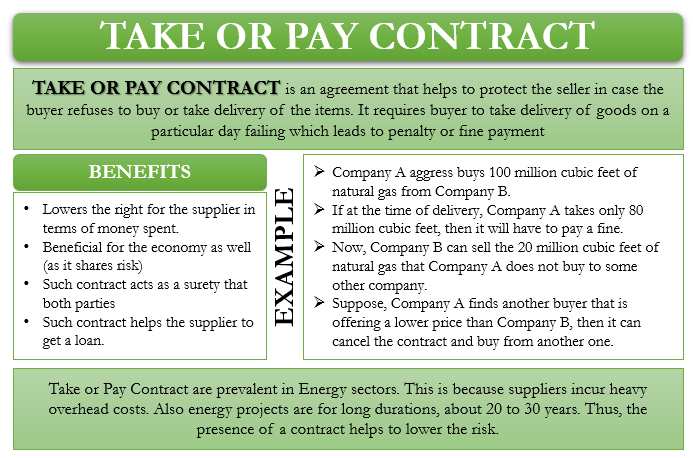

Because of the physical delivery limitations in the natural gas supply chain and its extremely high overhead, “take or pay” contracts are common. If you want firm supply, you've got to pay whether you use it or not.

A take or pay contract is an agreement that helps protect the seller if the buyer refuses to buy or take delivery of the items. It is an agreement in writing between the buyer and seller. The objective is to protect the seller if the buyer refuses to take the delivery of the items. Many also call this the “killing clause.”

Imagine yourself the fuel supply buyer for an efficient, dual-combined natural gas power plant having multi-party negotiations with your nentire supply chain—producers, interstate pipelines, storage facilities, and distribution pipelines (these are fun). In 2022, that kind of goes like this:

Supply Chain: “How much gas do you want to buy for delivery for each hour of each day in January of 2024?”

You: “I don't know. Let me consult the Old Farmer’s Almanac to see if it’s going to be extra windy, snowy, sunny, cloudy on each of those days. Crap, it ends in December. Well, we need to be able to run at 100% at a moment’s notice, but I won’t be able to actually use the gas if it’s windy. There’s this new thing that saves us lots of gas when the wind blows.”

Supply Chain: “Well, how ‘bout we charge you full price whether you actually use the gas or not?”

You: No problem. Since Take or Pay is part of my Cost of Service, I get to charge my customers for all that gas whether or not they use it.

Introducing highly unpredictable variability of the weather into the natural gas supply chain is yet another absurdity caused by over-reliance on wind & solar Rube Goldberg machines.

By the way, if you think that all this compressing, decompressing, moving, and storing of natural gas consumes a great deal of energy' you'd be right. There also appears to be a fallacy about storage—there are input and output limits. Storage output is another pipeline.

Conclusion

The introduction of chaos into any supply chain has economic and associated consequences. Curtailment is an enormous issue in energy because overhead is so high. When the wind blows or the sun shines, which Supply Chain Eats $0.00 Revenue? Either way, it’s you.

(this broken record has been playing my head for years so now ya'll get to hear it, too) End🧵

There are also losses in pipelines and storage. Remember that giant methane leak in southern California that upset everyone? Caverns have their limits. Methane is a gas, a colorless, odorless gas. That smell you notice is from incredibly stinky sulfur mercaptans that are added to the gas so it can be noticed.

There are contaminants, like water, that build up in pipelines, especially if the flow is low. Water freezing and blocking flow in pipelines that had been stagnant low-flow for a while is why in Texas during the last great ERCOT mess, the gas supply stopped. It didn't quite stop, but it was restricted because of ice in the lines. Little to do but wait until the ice melted.

I said "tried", but the system worked well, until a forest ranger in Smokey-Bear hat came to the gas company and complained of bubbles in the water, which he said were methane from the underground storage. The company initially said "no way" but the ranger was prepared. He presented Commonwealth Gas management with comparative mass spectrometer analyses of the gas in the lake bubbles and the gas from the company. He was right, so the storage facility was decomissioned.